Where To Buy Le Labo The Cheapest In 2025? (Cheapest Country, Discount, Price, VAT Rate & Tax Refund)

The Cheapest Country to Buy Le Labo

The cost of Le Labo is various by country, so many are wondering the cheapest country to buy Le Labo. Let's look at the Le Labo cost comparison between the US, Canada, Europe, Australia, South Korea, China, Hong Kong S.A.R. China, Singapore, Malaysia, and Japan. In this comparison, I will calculate the price difference with the currency exchange, sales tax and the VAT Refund amount.

For example, we will look at the price of Le Labo Another 13 (100ml / 3.4 fl oz eau de parfum). Pricing and exchange rates are as of September 26. 2024.

| Country & Region | Local Price | USD Equivalent Price | General VAT Rates |

| United States | $335 | $335 | 0%-9.55%(Sales Tax-different states vary) |

| Canada | CAD$406 | $301.36 | Combined federal and provincial/territorial sales taxes range from 5% to 16%. |

| United Kingdom | £234 | $311.87 | 20% |

| France | €295 | $328.52 | 20% |

| Italy | €295 | $328.52 | 22% |

| Germany | €295 | $328.52 | 19% |

Ireland | €295 | $328.52 | 23% |

| Finland | €295 | $328.52 | 24% |

| Sweden | €295 | $328.52 | 25% |

Japan | Ұ44,000 | $303.83 | Consumption tax: 10% |

| Australia | AU$505 | $344.87 | Goods and services tax: 11% |

| Singapore | €243 | $270.54 | Standard VAT rate: 9% |

Hong Kong S.A.R. China | €243 | $270.54 | There is no VAT or sales tax in Hong Kong. |

| Malaysia | €243 | $270.54 | 10% GST |

| South Korea | ₩446,000 | $335.06 | 10% |

| China | €243 | $270.54 | 13, 9, or 6% depending on the types of goods and services |

What is VAT?

The value-added tax (VAT) along with the goods and services tax (GST) is a consumption tax, which means it is paid by the private consumer. It is not a revenue tax. While over 160 countries use a value-added tax, it is most common in the European Union. It can be labelled VAT, TVA, IVA, moms, MwST, and a few others depending on each country.

VAT Rates: VAT is commonly expressed as a percentage of the total cost. For example, if a product costs $100 and there is a 15% VAT, the consumer pays $115 to the merchant.

Vat Tax Refund: It is a tax on consumption rather than income, and it ranges from 5-25%. If you pay this tax when shopping abroad, you can often get your money back after you've returned home, since travelers are typically entitled to a refund for the VAT portion of prices for goods.

Conclusion:

As you can see from the table above, if you are going to purchase the Le Labo, then you should definitely purchase it in Singapore, Hong Kong S.A.R. China, Malaysia, or China.

Buying Le Labo in Singapore, Hong Kong S.A.R. China, Malaysia, or China is about 20% cheaper than buying it in the United States.

However, the most expensive place to buy a Le Labo is in Australia.

Saving Tip: If you like online shopping, don't forget to sign up at Extrabux!(What is Extrabux) , then you can enjoy up to 30+% cashback on your purchase from Extrabux! Sign-Up Bonus: Free to join it & get $20 welcome bonus! Student Benefits:As long as you are a student at school, you can get a free whole year long VIP Card worth $199.

Extrabux.com cooperates with many merchants, such as: Rimowa (Up to 3.5% cashback), Walmart (Up to 4% cashback), Sephora(4% -5% cash back), Moosejaw (5% -6% cash back), LOOKFANTASTIC (Up to 10% cash back), Sam's Club (Up to 15% cashback), Norton(Up to 20% cashback), Microsoft (Up to 7% cash back) and so on. You can save on buying daily necessities, fashion, beauty, electronic products, broadband installation, mobile communication, air tickets, hotels and other aspects of life!

Tourist Refund Scheme in Singapore

Qualifying as a tourist

To be eligible for GST refund, you must be a tourist . You have to meet the following criteria:

1. You are 16 years of age or above on the date of the purchase;

2. You are not a citizen or a permanent resident of Singapore;

3. You are not a member of the crew of an aircraft on which you are departing Singapore; and

4. You are not a Specified Person -

A. an individual who has in force (i) any work pass issued by the Ministry of Manpower (i.e. Work Permit, Training Work Permit, S Pass, Employment Pass, Training Employment Pass, Personalised Employment Pass, EntrePass, Work Holiday Pass, Miscellaneous Work Pass and Letter of Consent); (ii) a Dependent's Pass; (iii) a Long Term Visit Pass or Long Term Visit Pass Plus; or (iv) a Student's Pass; or |

B. any of the following individual who has in force an Identification Card issued by the Ministry of Foreign Affairs Singapore and who is - (i) a diplomat, consular officer, an administration, technical or service staff or other staff appointed to or employed in any foreign Embassy, High Commission or Consulate in Singapore; (ii) a staff appointed to or employed in an International Organisation, Representative Office or Trade Office in Singapore; or (iii) a spouse or dependent child of any individual mentioned in B(i) and B(ii) above. |

Qualifying for the GST refund

You may qualify for tourist refund if the following conditions are satisfied:

Purchase the goods and request the retailer to capture your information for tourist refund;

Spend at least SGD100 (including GST). You may accumulate up to 3 same-day invoices/receipts from retailers bearing the same GST registration number and shop name to meet this minimum purchase amount;

Present original passport in person to the retailer to capture your passport information digitally at the time of purchase. Photocopies and images of your passport are not acceptable;

Apply for your GST refund at the eTRS self-help kiosk at the airports;

Depart with the goods within 2 months from the date of purchase either via:

Changi International Airport Departure Hall; or

Seletar Airport Passenger Terminal;

Depart with the goods within 12 hours after obtaining approval of your GST refund; and

Claim the refund from the approved central refund counter operator within 2 months from the date of approval of the application.

Goods that qualify for GST refund

All goods on which GST is charged ("standard-rated goods") are eligible for refund except:

Goods wholly or partly consumed in Singapore;

Goods exported for business or commercial purposes;

Goods that will be exported by freight; and

Accommodation in a hotel, hostel, boarding house, or similar establishments

Services are not eligible for GST refund under the Tourist Refund Scheme.

Retailers operating TRS

GST-registered retailers may choose to operate the scheme on their own or engage the services of Central Refund Agencies. Currently, there are 2 Central Refund Agencies in Singapore:

1. Global Blue Singapore Pte Ltd

Amount of GST refunded under TRS

The actual amount refunded to you will be less than the GST you have paid on your purchases due to the deduction of a handling fee for the refund service charged by the Retailer/Central Refund Agency/operator of Central Refund Counter.

The details of your transactions can be verified by registering and logging into the eTRS e-Services at https://touristrefund.sg or via the "eTRS" application downloadable from Google Play or Apple App Store.

Availability of TRS at points of departure

TRS is available to tourists bringing purchases out of Singapore within two months from the date of purchase via:

Changi International Airport; and/or

Seletar Airport.

Electronic Tourist Refund Scheme (eTRS)

When making purchases from retailers who are on eTRS, you must show your passport and your electronic Visit Pass (e-Visit Pass) issued by Immigration & Checkpoints Authority of Singapore (ICA) in person to the retailers to prove your eligibility under the TRS. Photocopies or images of passports are not acceptable.

Issue of eTRS transaction

The retailer will issue an eTRS transaction to you at the point of purchase with your passport details. When you apply for your GST refund at the airport's eTRS self-help kiosk with your passport, your transactions will be retrieved automatically.

Ensure that you are issued with an original receipt/invoice and eTRS transaction before leaving the shop.

Claiming GST refunds under TRS when departing

Arrive at the airports early to allow sufficient time for the processing of your GST refund and inspection of goods.

1. Goods for checking-in

If you have bulky goods or goods to be checked-in, please apply for your GST refund at the designated GST refund area in the Departure Check-in Hall before you check-in your purchases.

2. Goods for hand-carrying

For high value goods or goods that can be hand-carried, please apply for your GST refund in the Departure Transit Lounge (after Departure Immigration).

3. Self-Help Kiosks for all other goods

To claim, proceed to the eTRS self-help kiosk to apply for your GST refund. At the kiosk, you will be asked to:

3.1 Scan your passport

3.2 Make declarations

Declare your eligibility for TRS; and

Indicate if you accept the TRS conditions.

3.3 Verify your purchases

Confirm the purchases which you are bringing out of Singapore, and are therefore eligible for claim.

4. Choose your refund method

| Changi International Airport: | Seletar Airport: |

|

|

5. Check outcome of your refund request

Read carefully the outcome of your refund request shown on the kiosk.

If physical inspection of your goods is required, please present to the Customs Inspection counter:

your purchases/goods;

original invoices/receipts; and

boarding pass/confirmed air ticket.

6. Receive your refund

For credit card refund, the approved refund amount will be credited to the specified credit card within 10 days.

For refund via Alipay, the refund will be paid immediately into the specified Alipay account.

For cash refund at Changi International Airport, please proceed to the GST Cash Refund counter in the Departure Transit Lounge (after Departure Immigration) with your passport.

For bank cheques at Seletar Airport, you will be required to complete your particulars such as payee name and mailing address on the slip printed out from the kiosk. Once the slip is dropped into the designated cheque refund box provided, the bank cheque will be mailed to you 14 days from the date of deposit of the slip.

Tourist Refund Scheme in Malaysia

Here's a concise guide to help you claim your VAT refund efficiently:

①Eligibility check: Begin by confirming your eligibility for a VAT Tax Refund in Malaysia. This typically includes being a non-resident tourist and making eligible purchases intended for export. |

②Making qualifying purchases: Shop at approved 'tax-free' stores. At the time of purchase, keep your passport handy as you may have to show it to the store staff. Ensure the store is part of the VAT refund scheme by looking for a 'tax-free' sign or inquiring directly. |

③Obtaining a GST refund form: When you make a purchase, the store staff will issue a GST Refund Form. Ensure all details are filled out accurately, as this form is crucial for claiming your VAT Tax Refund. |

④Document safekeeping: Keep all purchase receipts and the GST Refund Form safe. These are essential documents for claiming your VAT Tax Refund and must be presented later for validation. |

⑤Customs validation at the airport: Prior to departing Malaysia, visit the Malaysian Customs at the airport. Present your passport, boarding pass, and purchased goods along with the Tax-Free Forms for validation. This step is essential to confirm the export of your purchased goods. |

⑥Claiming the refund: After form validation, proceed to the Tourist Refund Agent at the airport to process your VAT refund. Remember, refunds in Malaysia are typically not given in cash or credited to a credit card. |

⑦Understand the timeframe: Your purchases should be made within three months before departure, and the goods must comply with export regulations. |

⑧Exit through an approved airport: The tax refund is claimable only if you exit Malaysia via an approved international airport. |

⑨Goods inspection: Ensure that your goods are available for inspection and not packed in checked luggage before they are inspected by Customs officers. |

Eligibility of VAT Refund

①Tourist status: The refund is specifically for tourists, meaning non-residents of Malaysia. This policy aims to exclude VAT for goods that aren't consumed domestically but are instead exported. |

②Qualifying goods: Eligibility applies to goods that are not consumed in Malaysia and are intended for export. Items prohibited from export or consumed within the country do not qualify for a refund. |

③Minimum purchase requirement: There is a minimum spending threshold to qualify for a VAT refund, typically around MYR300 This total should be from purchases made in approved stores participating in the VAT refund scheme. |

④Purchase and refund process compliance: Tourists must comply with the refund process, which includes presenting their passport at the time of purchase, accurately completing the GST Refund Form, and retaining all purchase receipts. These documents, along with the purchased goods, must be presented for validation at the Malaysian Customs Department at the airport prior to departure. |

⑤Timeframe for export: The goods must be exported within a specific period, generally within three months from the date of purchase, to be eligible for the refund. |

⑥Mode of departure: The refund is claimable only if exiting Malaysia via an approved international airport, as the refund process is tied to customs verification counters and refund agents at these locations. |

Mastering the VAT Tax Refund process in Malaysia can lead to significant savings during your visit. By following the essential steps and ensuring compliance with the guidelines, you can effectively reclaim the VAT on your purchases.

Tourist Refund Scheme in China

Overseas tourists may claim VAT refunds for tax refundable goods purchased at tax-free shops when leaving Chinese mainland via ports of exit. Overseas tourists include foreigners and compatriots from Hong Kong, Macau and Taiwan who stay in Chinese mainland for a period of no more than 183 consecutive days.

Conditions for Application

1. An overseas tourist shall make a purchase of tax refundable goods worth of at least CNY 500 in a single tax-free shop on a single day; and |

2. The tax refundable goods have not been used or consumed by the departing purchaser; and |

3. The departure date shall not be later than 90 days after the purchase date of tax refundable goods; and |

| 4. The tax refundable goods shall be carried by the overseas tourist himself (herself) or transported along with the checked baggage. |

Material Required

1. Valid identity documents |

2. Refund Application Form for Overseas Visitors verified and stamped by Customs |

| 3. VAT invoices for tax refund items |

Tax Refund Rate

For refundable items with an applicable tax rate of 13%, the tax refund rate is 11%; for those with an applicable tax rate of 9%, the tax refund rate is 8%. The tax refund agency will charge commission at a rate of 2% of the VAT-inclusive invoice value of the goods.

Tax Refund Method

Tax refunds will be made in RMB. For Tax refunds of more than RMB 10,000 in total, they will be made by bank transfer. For Tax refunds of no more than RMB 10,000, they may be made either in cash or by bank transfer at the option of overseas tourists.

Is Le Labo cheaper in Europe?

In fact, buying Le Labo in Europe is not the cheapest, but because their VAT Rates are relatively high, it will be about 15% cheaper than buying in the United States after tax refund.

Where to Buy Le Labo Cheapest in the USA?

You can also buy your Le Labo at the tax-free states in the USA. In the United States, the tax paid at the time of shopping and checkout is usually a comprehensive consumption tax, namely Combined Sales Tax, which is composed of the fixed state consumption tax (State Sales Tax) of each state + the local consumption tax (Local Sales Tax) of different regions , which results in different consumption taxes in different regions even within the same state.

Among the states in the United States, there are 5 tax-free states (Alaska is free of State Sales Tax, and some areas charge Local Sales Tax): Oregon, Delaware, Montana, New Hampshire, Alaska (part).

Where To Buy Le Labo The Cheapest Online?

If you’re not going to Singapore, Hong Kong S.A.R. China, Malaysia, or China any time soon, then you can check out these online sites to buy new & used Le Labo. It is very convenient to buy online, and it will be delivered directly to your door. And there are deals, as these retailers occasionally have promo codes where Le Labo is included.

Cult Beauty is an online retailer that sells beauty, makeup, and skincare products from around the world. Cult Beauty sources products from all over the world, including independent brands, emerging brands, and established brands. You can purchase Le Labo fragrance, body care, travel sized, candles, and grooming on Cultbeauty.com.

Le Labo Prices: €18.08-€264.42

Payment Methods: Visa, PayPal, MasterCard, Amex, Apple Pay, Google Pay, Klarna, and Amazon Pay..

Coupon or Discount:

Sign up at Cult Beauty & get 15% off your 1st order;

Free shipping on orders over £40.

Extrabux Cash Back: up to 8% Super Cash Back.

Selfridges is a British high-end department store founded in 1909 by Harry Gordon Selfridges. Its flagship store in Oxford Street, London opened on March 15, 1909 and is now the second largest department store in the UK after Harrods. After several changes, it was acquired by Sears in 1965 and extended from London to Manchester and Birmingham under the operation of Sears. You can buy Le Labo fragrances, candles, bath & bodycare at the Selfridges US site.

Le Labo Prices: $18.50 - $270

Payment Methods:

All major credit and debit cards (including prepaid cards) from Visa, Mastercard, American Express and Maestro.

PayPal is accepted for all currencies except for Chinese Yuan.

Apple Pay is accepted for all currencies except Australian Dollars.

Klarna is available for British Pounds.

Coupon or Discount:

Sign up at Selfridges for free shipping;

Sale: up to 50% off women's and shoes..

Extrabux Cash Back: Up to 7% Super Cash Back.

Saks Fifth Avenue was the brainchild of Horace Saks and Bernard Gimbel, who operated independent retail stores on New York's 34th Street at Herald Square in the early 1900s. Their dream was to construct a unique specialty store that would become synonymous with fashionable, gracious living. The combined financial input of these great merchant families led to the purchase of a site between 49th and 50th Streets on upper Fifth Avenue, then jointly occupied by the Democratic Club and the Buckingham Hotel.

With the opening of its founders' "dream store" on September 15, 1924, Saks Fifth Avenue became the first large retail operation to locate in what was then primarily a residential district. By offering the finest quality men's and women's fashions, as well as an extraordinary program of customer services, Saks Fifth Avenue has become the byword for taste and elegance. Saks Fifth Avenue offers a lineup of Le Labo beauty & home items.

Le Labo Prices: $35-$535

Payment Methods: American Express; Apple Pay; Diners Club; Discover; Klarna; Mastercard, PayPal.

Coupon or Discount:

Sign Up for Email and Enter for a Chance to Win a $1,500 Gift Card;

10% off your order when you create an account with ACCOUNTSF;

Free shipping on all order of $300+, Use Code FREESHIP;

Up to 60% off designer sale.

Extrabux Cash Back: 2% Super Cash Back.

Niche New York-based fragrance brand Le Labo hand-manufactures unique scents composed by some of the world's finest noses. Working with raw ingredients processed in Grasse, France, each one is built around a primary natural essence. Expect high quality natural oils, soy wax candles and strikingly modern perfumes. Don’t miss the luxe Le Labo beauty & home in NET-A-PORTER edit.

Le Labo Prices: $20-$335

Payment Methods: Visa, MasterCard and American Express, Maestro, JCB cards, PayPal, Apple Pay, Klarna, Affirm, Union Pay.

Coupon or Discount:

Free standard delivery on orders of $200+;

Up to 60% off sale items;

EXTRA 15% OFF Enter code EXTRA15 at checkout. Terms and conditions apply.

Sign up at NET-A-PORTER for 10% off your 1st order;

Download NET-A-PORTER app to enjoy 10% on your first order – simply enter code APP10 at checkout. T&Cs apply.

Extrabux Cash Back: Up to 3% Super Cash Back.

Bloomingdale's is committed to once again lead the way with exclusive merchandise, customized services, and alternative shopping venues. Carrying on the Bloomingdale's brothers' dream, they're always finding ways to set their stores apart. Bloomingdale's offers Le Labo fragrances, candles, bath & body, and grooming.

Le Labo Prices: $20 - $535

Payment Methods: MasterCard, VISA, American Express, PayPal, etc.

Coupon or Discount:

Sign up at Bloomingdale's for 15% off your 1st order;

Up to 40% off select styles;

Become a Loyallist to get free shipping every day and earn points while you shop;

Open a Bloomingdale's Credit Card and take 20% off your Bloomingdale's purchases today and tomorrow (up to a total savings of $250 over the two days).

Extrabux Cash Back: 2% Super Cash Back.

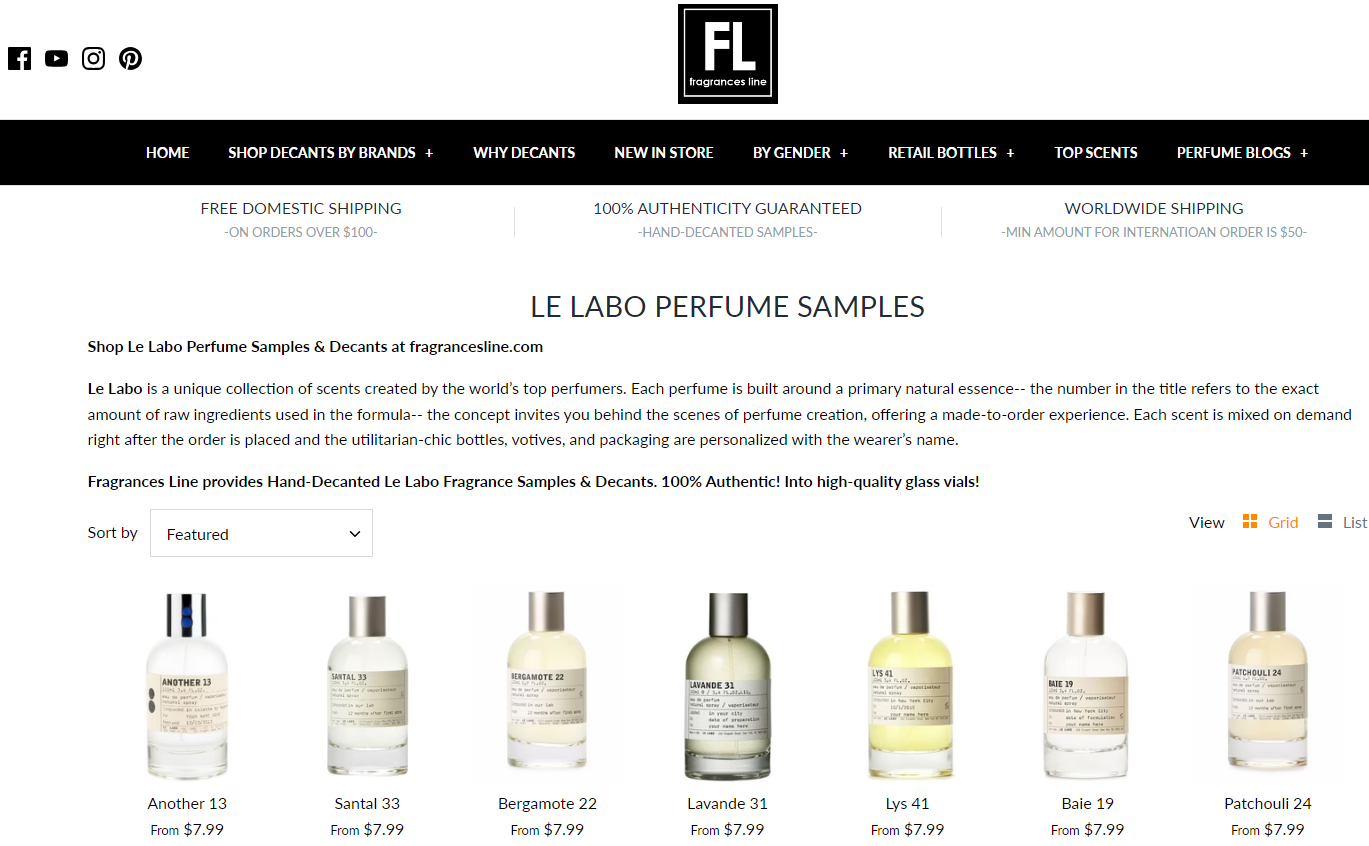

Le Labo is a unique collection of scents created by the world’s top perfumers. Each perfume is built around a primary natural essence-- the number in the title refers to the exact amount of raw ingredients used in the formula-- the concept invites you behind the scenes of perfume creation, offering a made-to-order experience. Each scent is mixed on demand right after the order is placed and the utilitarian-chic bottles, votives, and packaging are personalized with the wearer’s name. Fragrances Line provides Hand-Decanted Le Labo Fragrance Samples & Decants. 100% Authentic! Into high-quality glass vials!

Le Labo Prices: from $7.99

Payment Methods: credit card and PayPal.

Coupon or Discount:

Free domestic shipping on orders over $100;

Sign up at Le Labo for 5% off your order.

Extrabux Cash Back: Cashback temporarily unavailable.

eBay is an American multinational e-commerce company based in San Jose, California, that facilitates consumer-to-consumer and business-to-consumer sales through its website. eBay was founded by Pierre Omidyar in 1995, and became a notable success story of the dot-com bubble. At eBay, they create pathways to connect millions of sellers and buyers in more than 190 markets around the world. eBay is also a great place to buy new & pre-owned Le Labo.

Le Labo Prices: $2.25 - $2,399.99

Coupon or Discount:

Free shipping on select items.

Extrabux Cash Back: 4-4.6% Extrabux cash back.

And you can also buy Le Labo at Walmart (Up to 4% cashback), and Amazon.com.

Read More:

Where To Buy Rimowa The Cheapest In 2025? (Cheapest Country, Discount, Price, VAT Rate & Tax Refund)

Where To Buy Goyard The Cheapest In 2025? (Cheapest Country, Discount, Price, VAT Rate & Tax Refund)

Where To Buy Loewe The Cheapest In 2025? (Cheapest Country, Discount, Price, VAT Rate & Tax Refund)

Where To Buy Tumi The Cheapest In 2025? (Cheapest Country, Discount, Price, VAT Rate & Tax Refund)

Where To Buy YSL The Cheapest In 2025? (Cheapest Country, Discount, Price, VAT Rate & Tax Refund)

Where To Buy Hermès The Cheapest In 2025? (Cheapest Country, Discount, Price, VAT Rate & Tax Refund)

Where To Buy Prada The Cheapest in 2025? (Cheapest Country & Place, Discount, Tax Refund)

Where To Buy Burberry The Cheapest in 2025? (Cheapest Country & Place, Discount, Tax Refund)

Where To Buy Tiffany Jewelry The Cheapest in 2025? (Cheapest Country, Price, VAT Rate & Tax Refund)

Extrabux is an international cashback shopping site, offering up to 30% cashback from 10,000+ Stores!

LOOKFANTASTIC, SkinStore, SkinCareRx, Feelunique, Cult Beauty, Sephora, Belk, Estee Lauder, Lancome, La Mer, Kiehl's, Clinique, Elizabeth Arden, Adore Beauty, Sol de Janeiro, Hourglass, Lancer, Shiseido, FOREO, Macy's, etc.

Join to get $20 welcome bonus now! (How does Welcome Bonus work?)

Recommendation

-

Is Turkish Airlines Good for International Flights?

-

10 Best & Stylish Winter Coats for Women on NET-A-PORTER in 2025

-

Top 12 Items That Are Always Cheaper at Sam's Club!

-

Top & Best 12 Sneaker Apps/Websites for Raffles, Releases & Restocks in 2025

-

7 Best Gift Card Exchange Sites - Buy, Sell and Trade Discount Gift Card Safely and Instanly!