Coinbase vs. Gemini vs. eToro Comparison: Fees, Features, Security & Reviews 2025

Cryptocurrency investing has been booming in popularity in the last few years. From financial institutions to everyday investors, more and more people are interested in cryptocurrency these days. And if you're ready to add digital assets to your portfolio, choosing one right cryptocurrency exchange or platform can help you avoid both real scams and high fees that feel like scams. eToro, Coinbase, and Gemini are three leading cryptocurrency trading platforms in the US. They each have distinct advantages to offer, but they're not right for every trader. So which one should you choose?In this Coinbase vs. Gemini vs. eToro comparison, I will take a deep dive into everything from security to available cryptocurrencies and trading fees to help you decide which is the better platform for your trading strategy.

Overview of Coinbase, Gemini and eToro

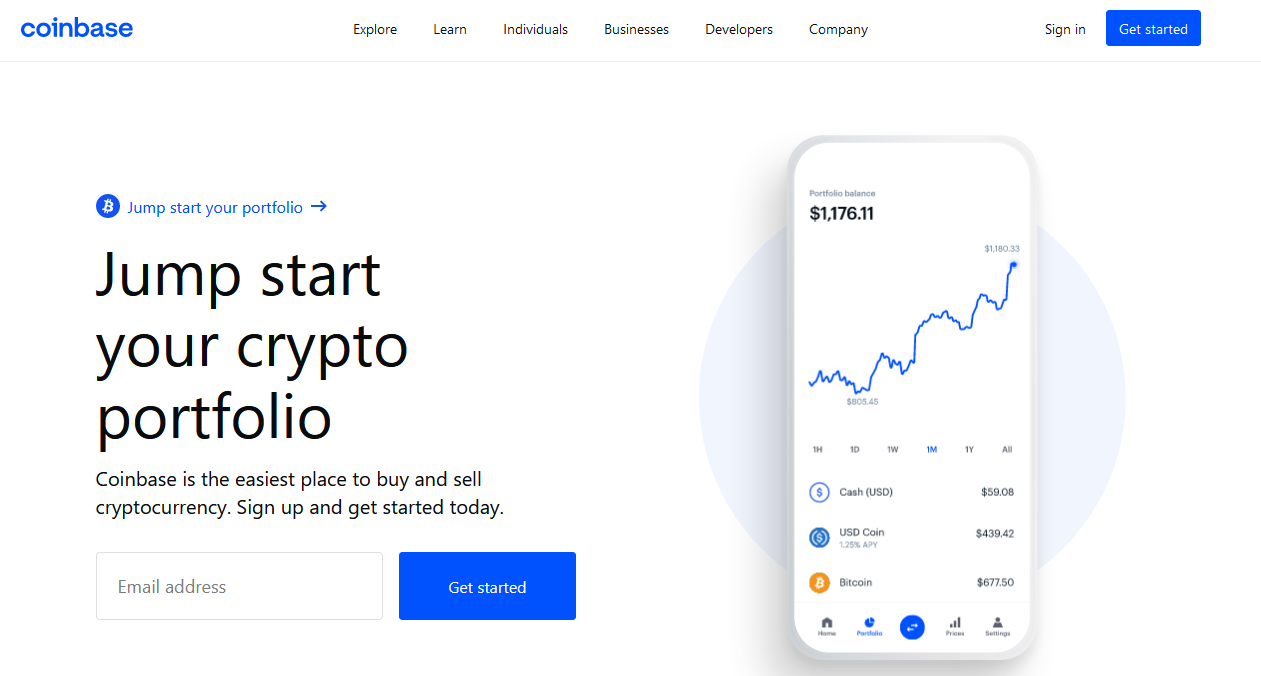

A name that has been synonymous with cryptocurrency trading for almost a decade, Coinbase is the first place over 89 million people think of when asked about crypto trading platforms. And with extensive coin support, you can buy popular cryptos like Bitcoin or Ethereum plus plenty of altcoins. A user-friendly interface, easy onboarding process, and free $5 Bitcoin account opening make Coinbase a great place to get started for new traders. Its security makes it one of the most secure cryptocurrency platforms.

Coinbase also has staking rewards and a crypto rewards card that pays up to 4% back in crypto on daily spending. And there's even a new Coinbase Learn program that pays you with free crypto for completing short educational modules. On the downside, Coinbase is more expensive than other cryptocurrency exchange sites and has only a few payment options. Users need to be aware of the high transaction fees attached to transactions, which are part of the intricate fee structure on Coinbase's website.

| PROS | CONS |

| Easiest to use interface | High Coinbase trading fees, especially for small trades |

| Incredibly beginner-friendly | Few payment options |

| Wide selection of cryptocurrencies | User doesn't control wallet keys |

| Earn staking rewards for passive income | Lack of advanced exchange features |

| Earn free crypto with Coinbase Learn | |

| Fantastic security features |

Save Tips:

If you want to trade cryptocurrency on Coinbase, Sign up at Extrabux first, then you can earn up to 50% cashback! (What is Extrabux), Sign-Up Bonus: Free to join it & get a $20 welcome bonus!

Gemini is another leading cryptocurrency exchange which has been around since 2014. The company offers a vast range of services, including affordable crypto trading, storage, and payment solutions.Since it is regulated, to the extent cryptocurrency exchanges are regulated, and the leadership prioritizes security and transparency, you can trade crypto all over the world with confidence. Gemini supports about 90 coins, including bitcoin cash, bitcoin, ethereum, litecoin and dogecoin.The exchange provides a welcome bonus of $20 for any user who trades $100 or more within 30 days.

The best thing about Gemini is that it provides insurance for all crypto holdings, against hacking incidences. Gemini also supports peer-to-peer trading among its users. The exchange allows users to trade a minimum of 0.00001 bitcoin or 0.001 ether. In addition, offerings like Gemini Earn, Gemini Pay, Gemini Wallet, and more can help investors tap into a more cohesive ecosystem than other exchanges may offer. Gemini's main drawback is that its fee structure is somewhat complicated. Normal mobile and web orders charge various fees depending on the order amount.

| PROS | CONS |

Simple interface for beginners, combined with more advanced options for active traders | Confusing fee structure for beginners |

| About 100 cryptocurrencies to choose from | Mobile and web fees are slightly higher than some other exchanges |

Over-the-counter (OTC) peer-to-peer crypto trading | Customer support only available via email |

Crypto-to-crypto trading available for certain coins | |

Cash is FDIC-insured and Gemini has digital asset insurance | |

| Strong security measures |

eToro has been around since 2007 and is often referred to as the social trading platform. First, as one of the world’s largest trading markets for exchange-traded funds (ETFs), stocks, fiat currencies, indices, and commodities, it’s a one-stop-shop for traders of all persuasions; crypto is simply one of the more popular options at the moment. And now, eToro supports crypto trading for over 40 popular coins. Moreover, users can chat via public walls and blog posts, discuss strategies or market outlook, and utilize helpful analytical tools. They can also view their peers’ portfolios and glean crypto-related tips from them.

What's nice is that eToro not only has a simple crypto trading interface for beginners, but also offers eToro Exchange for advanced traders which gives more sophisticated features and an expanded list of assets.Even better, beginners who do not want to lose their real money on the trading platform can try the exchange with a $100,000 virtual portfolio with a demo account. eToro crypto trading isn't as robust as dedicated crypto exchanges and it supports fewer crypto assets than many competitor exchanges, but it still has advanced trading tools.

| PROS | CONS |

Simple and advanced trading dashboards are available | Limited cryptocurrencies |

Low minimum to fund an account and begin investing | Slow customer service response time |

Platform offers an engaging communal experience | Can't withdraw crypto directly |

Users can copy the crypto trading strategies of advanced users | |

| Straightforward fee structure | |

| Regulated in numerous jurisdictions |

Coinbase vs. Gemini vs. eToro : Full Comparison

Before diving into my in-depth discussion, look at the table below to get a basic faeture of these three cryptocurrency trading platforms.

| Coinbase | Gemini | eToro | |

| Main Platform Features | Beginner-friendly exchange with an intuitive interface, can withdraw funds to PayPal | Beginner-friendly and secure interface, multiple buying and selling options, and ability to earn interest on stored crypto | User-friendly brokerage and social trading platform, ability to interact with other traders, can buy funds using PayPal (outside the U.S.) |

| Supported Cryptos | 100+ | 90+ | 40+ |

| Fees | 1.49% to 3.99% | $0.99 to $2.99 or 1.49% depending on order value | 1% for buying and selling |

| Minimum Trade | $2 | Varies by crypto | $10 |

| Crypto Rewards | Staking and crypto rewards card | Staking | Staking |

| Fiat Support | Yes | Yes | Yes |

| Security Features | 2FA verification, biometric fingerprint logins, KYC, FDIC-insured USD balances,2 cold storage, AES-256 encryption for digital wallets | Two-step verification, FDIC-insured USD balances up to $250,000,1 Gemini Wallet digital insurance, U2F security with a hardware key, and cold storage | 2FA verification, cold storage, FDIC-insured USD balances,multi-signature facilities, and private keys, KYC |

| Types of Transactions Supported | Buy, sell, send, receive, and exchange | Buy, sell, trade, deposit, and withdraw | Buy, sell, market orders and limit orders |

| Maximum Trading Amount | Limits vary based on your payment method and region. $25,000 a day ACH transfers for U.S. customers | $5,000 daily and $30,000 a month for deposits and $100,000 daily for withdrawals via ACH. $1,000 daily for debit card purchases. | $50,000 per transaction and $200,000 a day send limits for most coins, including BTC |

| Mobile App | Yes | Yes | Yes |

| Wallet App | Yes | Yes | Yes |

Unique Features

Coinbase makes buying cryptocurrencies super easy. You can fund your account and buy cryptocurrencies right away, but you will have to wait for the funds to clear from the bank before you can withdraw them. Coinbase's unique features include Coinbase Earn, where you can earn free cryptocurrency to learn about certain new coins. You only need to hold eligible stablecoins such as Dai and USD Coin to earn interest. Its own stablecoin USD Coin earns 0.15%.

Gemini is more than just a cryptocurrency exchange. It's more like a bank for your cryptocurrency. It offers features to help you build a portfolio with interest rates as high as 7.4% on some cryptocurrencies. It also offers an active trading platform, third-party clearing services, external software wallets, payment platforms and credit cards. Gemini has its own stablecoin — the Gemini Dollar (GUSD) — a cryptocurrency pegged to the U.S. dollar.

eToro is a global platform that in the U.S. offers only crypto trading. The main unique feature is the trademarked CopyTrader system, where you can automatically copy other people's trades in real-time. If there is a trader you trust who can keep earning a small fortune, you can use CopyTrader to mimic their gains (and losses). If you are a popular trader, you can profit from popular investment programs, potentially making thousands of dollars a year.

Supported Currencies

All the three cryptocurrency trading platforms accept fiat currencies. Due to eToro features many trading pairs, it supports more fiat currencies including USD, GBP, and EUR. By comparison, you can withdraw eToro funds in USD, EUR, GBP, AUD, RMB, THB, IDR, MYR, VND, PHP, SEK, DKK, NOK, PLN, CZK. Whereas Coinbase and Gemini have fewer fiat currencies supported. Gemini supports seven types: USD, AUD, CAD, EUR, GBP, SGD, and HKD, while Coinbase only supports three: USD, GBP, and EUR.

Compared to eToro, Gemini and Coinbase support trading of more cryptocurrencies. Both platforms offer popular crypto, like Ethereum (ETH), Aave (AAVE), Litecoin (LTC), Dai (DAI), Bitcoin Cash (BCH), Chainlink (LINK), Uniswap (UNI) etc. However, Coinbase offers many more altcoins than Gemini does. For instance, you can’t purchase Dash, EOS, Cardano (ADA), and Ethereum Classic (ETC) on Gemini.

Trading Fees

The spread fee for buying and selling cryptocurrencies on Coinbase is approximately 0.50%, but there is also a Coinbase fee that represents the greater value between a fixed fee and a variable percentage fee determined by region, product feature, or payment type. Flat fees range from $0.99 (total transaction value less than or equal to $10) to $2.99 (more than $50 but less than or equal to $200). Percentage fees in the US range from 1.49% (US bank accounts and Coinbase wallets) to 3.99% for debit card purchases. ACH deposits are free, while wire transfers cost $10 ($25 outgoing).

The trading fees of Gemini are tiered, with orders of up to $10 incurring $0.99 and orders of $200 and over incurring 1.49% of the order value. For orders of up to $25, $50, and $200, the fees are $1.49, $1.99, and $2.99, respectively. The best rates are reserved for Gemini users with ActiveTrader accounts, based on the “maker/taker” system. For makers, the fees range from 0% to 0.25%, inversely proportional to the value of their orders. Takers can expect to pay between 0.03% and 0.35% for a trade, with the price also going down the more they order.

eToro has a simple 1% trading fee whenever you buy or sell crypto. This is higher than many crypto exchanges but it's also easier to understand. If you're new to crypto investing, this fee structure is easy to understand, although it's not the most cost-effective option in the long-run.

Security

Gemini, Coinbase and eToro are all large companies with legal licenses to operate in the U.S. There's no guarantee the U.S. Treasury Department won't make cryptocurrencies illegal. But your funds are generally considered safe at these three major exchanges.

Almost 100% of Coinbase’s user crypto funds are held in cold-storage locations around the globe, with wallets featuring 256-bit AES encryption.You are required to submit your banking information for direct deposits and personally identifiable information, such as your passport, to verify your account. All data is securely stored, and Coinbase will never share it with third parties.Coinbase also features a 2FA system with Google Authenticator as a backup, and its USD wallet is covered up to $250,000 in losses by FDIC Insurance.

Gemini secures users’ digital assets

through multi-layered security measures, which are highlighted on its

website. The “majority” of your cryptocurrency is held in an offline,

cold storage system — the safest way to protect cryptocurrency from

hackers. But a small portion is kept in an online hot wallet that is

insured against theft from a security breach, hack, a fraudulent

transfer, or employee theft.

eToro employs security measures that are on par with what you’d expect from one of the world’s leading crypto exchange marketplaces. In addition to industrial-grade encryption, it also features toggleable two-factor authentication, and biometric unlocking measures for its mobile/wallet apps.You also need some official ID such as a valid passport or driver’s license to verify your account. The biggest security risk may be for users of eToro's copy trading tools, as your portfolio can execute trades and lose money without your input. But your accounts should be safe from hackers and other digital bad guys as long as you maintain good password security and follow personal cybersecurity best practices.

Customer Support

If you need to get in touch with customer service, all three platforms offer comparable services.Coinbase offers live phone support and you can also use the Virtual Assistant live chat to solve your issues.. There is also a very detailed and well-written FAQ section on the site for self-starters.

The primary channel for contacting Gemini customer support is email, but you can also reach out via a toll-free phone number or Twitter. You can also consult various FAQ documents on the site, or use the Gemini Bot “live chat” feature to find a solution to your issue.

eToro 's customer support is offered through a system of email tickets, and a detailed Help Center, which contains lots of excellent articles. If you join eToro as a member, you can then get phone and live chat support. But they recommend checking their Help Center for answers to your questions, as responses can take up to 14 days.

Coinbase vs. Gemini vs. eToro: Verdict

Whether Coinbase, Gemini or eToro is the “best” choice is personal to you, depending on your goals and preferences as an investor.

Of the three, Coinbase has a notable edge in terms of cryptocurrency selection. If you plan to invest in lots of different coins, then Coinbase is likely the right exchange for you. Experts can save on fees using the affiliated Coinbase Pro platform.

Gemini is one of the most secure exchanges available on the market, If you're concerned about hacks and breaches, and value peace-of-mind above all else, it's probably the right fit for you. Moreover, thanks to the Gemini Earn feature, Gemini is a also great option for those looking to earn interest on their cryptocurrency.

Thanks to the noted CopyTrader feature, eToro is better for active traders who want a social aspect to their account, with copy trading and other social features to learn from others and discuss strategy.In addition, if you want to manage all your stock, ETF and crypto in one place, eToro is also your best choice. This online broker has always been a popular choice for stock trading.

Extrabux is an international cashback shopping site, offering up to 30% cashback from 10,000+ Stores!

Squarespace, SkinStore, MATCHESFASHION, The Wall Street Journal, NordVPN, Visible, Armani Exchange, Sam's Club, PUMA, AliExpress, Card Cash, NET-A-PORTER, Udacity, Udemy, Selfridges, LOOKFANTASTIC, Vimeo, Coach Outlet, lululemon, PrettyLittleThing, Booking.com, Ripley's Aquarium, iHerb, Groupon, etc.

Join to get $20 welcome bonus now! (How does Welcome Bonus work?)

Recommendation

-

Is Turkish Airlines Good for International Flights?

-

10 Best & Stylish Winter Coats for Women on NET-A-PORTER in 2025

-

Top & Best 12 Sneaker Apps/Websites for Raffles, Releases & Restocks in 2025

-

7 Best Gift Card Exchange Sites - Buy, Sell and Trade Discount Gift Card Safely and Instanly!

-

Top 9 Professional Skincare Brands for Licensed Estheticians 2025