If you are self-employed or a freelancer, you aren’t alone. In fact, there are more freelancers today than there have ever been. A 2019 study by Upwork and Freelancers Union shows that 57 million Americans freelanced in 2019. If you’re among the 57 million self-employed Americans, you may worry about finding quality, affordable health insurance. So we created our list of the best health insurance for self-employed workers by comparing 8 of the top providers, including each company’s history, reputation, convenience, nationwide availability, claims process, and more. Read on to find out who were our top picks for self-employed health insurance.

The 8 Best Health Insurance for Self-Employed in 2025

Best Overall: Blue Cross Blue Shield

Best Network: UnitedHealthcare

Best for Preventative Care: Kaiser Permanente

Best for Convenience: Cigna

Best for Underserved Groups: Molina Healthcare

Best for Customer Service: Oscar

Best for Older Self Employed Professionals: Humana

Best Short-Term Health Insurance: Pivot

How Do I Know If I Need Self-Employed Health Insurance?

If you don’t have an employer or employees, but you bring home taxable income, then you most likely need to find independent contractor health insurance through an individual or family plan. Some examples of individuals who might enroll for self-employed health insurance:

Independent contractor

Freelancer

Consultant

If this description seems to apply to you, it’s important to explore your options for self-employed health insurance. Getting coverage for yourself, no matter your job status, may help you avoid paying a penalty for being uncovered. Please note that starting with the 2019 plan year, you’ll no longer owe a federal tax penalty if you can afford health coverage and decide not to get it. However, states may have different rules, and you may owe a state fee for going uncovered.

As of 2019 the Obamacare Individual mandate – which requires you to have health insurance –no longer applies at the federal level. However, 5 states and the District of Columbia have an individual mandate at the state level.

You may have to pay a penalty for not having health insurance if you live in one of the following:

Massachusetts

New Jersey

Vermont

California

Rhode Island

District of Columbia (Washington D.C.)

Even where not mandatory, health insurance can provide a safety net for you and your family. Often, it’s best to view insurance as coverage for the big expenses — the type of expenses that can change your lifestyle or leave you burdened with medical bills for years.

Please note that if you have even one employee other than yourself, you may be eligible for small business group health insurance instead, which works well for people who are responsible for insuring their employees in addition to themselves.

If you usually shopping online, don't forget to sign up at Extrabux (What is Extrabux?), then you can enjoy up to 30% cashback from Extrabux when you finish your purchase! Sign-Up Bonus: Free to join it & get a $20 welcome bonus!

What Affects Health Insurance Costs?

Unlike other types of insurance, like home or auto insurance, where literally hundreds of factors can affect your rates, health insurance uses a limited number of individual rating factors that can affect your premiums.

Age: Expect to pay more for your health insurance as you get older.

Location: State rules and localized cost of services can affect your premiums.

Tobacco use: Insurers can charge up to 50% more for tobacco users. However, some states prohibit the practice or limit the additional premium based on tobacco use.

Individual vs. family: Plans that extend coverage to family members cost more than plans limited to individuals.

Plan features, such as the structure of the deductible or out-of-pocket limits, affect the cost of premiums as well.

What to Look for in a Self-Employed Health Insurance Plan?

Each household has its own priorities. Some households may place physician choice above monthly cost. Other households might prioritize monthly affordability over occasional expenses, like higher copays or coinsurance.

While your priorities may differ from those of your neighbor, be aware of the potential costs when choosing a health insurance provider. The monthly premium for your health insurance only tells part of the story. In a year in which your healthcare needs are higher, your cost can skyrocket if you choose a plan that has lower premiums but which has higher deductibles, co-pays, coinsurance, or a higher maximum out-of-pocket limit.

Best Overall: Blue Cross Blue Shield

Blue Cross Blue Shield is our top choice for best overall as their coverage spans all 50 states, and they offer a large array of policies to suit most people. Blue Cross Blue Shield maintains one of the largest networks and insures 1 out of every 3 Americans — a vital asset if you live in a rural area where fewer health insurance companies operate.

| Pros | Cons |

Strong company reputation | Member experience may vary by region |

Large provider network | Bad ConsumerAffairs reviews in many states |

| Data-driven to improve quality and affordability | Plans offered through regional companies, meaning you must look to your regional company for specific policies |

Coverage in all 50 states and outside the country | |

Covers both generic and brand-name drugs | |

Wide network of doctors, hospitals and specialists | |

| Smartphone app and telehealth |

Blue Cross Blue Shield (BCBS) is an association of 36 independent Blue Cross Blue Shield companies across the United States. Since 1929, the association has established a strong reputation, and most of its companies have high AM Best ratings. The companies have scored 2.5 to 4.5 on a scale of 1 to 5 from the National Committee for Quality Assurance (NCQA). Blue Cross Blue Shield companies also earned high rankings in the J.D. Power 2020 U.S. Commercial Member Health Plan Study.

Blue Cross Blue Shield offers coverage to 107 million members in all 50 states, Washington, D.C., and Puerto Rico. The companies have an expansive network including 96% of the country’s hospitals and 95% of doctors and specialists. Expats may also have health coverage through the company’s global network. Depending on the state, Blue Cross Blue Shield companies may offer a variety of products. You may also have access to health and wellness discounts like gym memberships and fitness products through Blue365.

You may compare plan quotes and apply for health insurance through your local Blue Cross Blue Shield company’s website. You can also call or sign up through your state’s health insurance exchange or Healthcare.gov. With 36 different companies, prices may vary by location, plan type, age, tobacco use, and the size of your family.

After receiving healthcare, visiting a hospital, or getting a prescription, the provider submits a claim to Blue Cross Blue Shield. You may access a claim summary, including how much you owe, by logging into your online portal or by mail.

Self-employed workers may like Blue Cross Blue Shield’s data-driven approach, like the company’s National Health Index, which maps health status by county. Blue Cross Blue Shield also uses nationwide data to address major issues like the rising cost of healthcare.

All in all, an American icon, Blue Cross Blue Shield is a time-tested insurer made up of dozens of regional companies that span the U.S. Plan availability varies based on location, which is common in the health insurance industry but may be more pronounced with BCBS and its federation of health insurance companies. Customers can expect a wide network of healthcare providers and a strong assortment of plans in most areas.

Best Network: UnitedHealthcare

UnitedHealthcare earns a spot on our list because it offers coverage in all 50 states and has the best network of healthcare providers. The company also stands out with technology, which may make their providers more efficient and affordable. As one of the largest health insurance providers in the United States, UnitedHealthcare is available in nearly every ZIP code.

| Pros | Cons |

Large network of providers | Mixed reviews on ConsumerAffairs |

Robust healthcare technology | May be more expensive than competitors |

| Solid reputation | |

Smartphone app and telehealth |

UnitedHealthcare is a subsidiary of UnitedHealth Group, the biggest health insurance provider in the country. Founded in 1977, the provider has an A rating from AM Best. With an A rating from AM Best, you won’t need to worry about their ability to pay any claims as they are financially stable. UnitedHealthcare didn’t earn a top spot in any region in the J.D. Power 2020 U.S. Commercial Member Health Plan Study.

As one of the largest U.S. health insurance companies, United Healthcare was an obvious choice for our best network choice. The United Healthcare network includes more than 1.3 million doctors and 6,500 hospitals and other facilities across the country, so you shouldn’t have difficulty finding local health services.

United Healthcare offers products including individual health insurance, short-term health insurance, dental and vision plans, Medicaid, Medicare and Medicare Advantage plans, and small-business health insurance.

You can get a quote and buy a plan using the online portal or the ACA Marketplace. You’ll find five coverage levels, from basic through to platinum coverage. Prices were not listed on the company website. Rates are discounted if you add coverage for dental or vision care.

Individual health insurance policies through UnitedHealthcare (UHC) are more expensive than average; however, plans will most often come with added benefits and access to wellness programs. Additionally, many customers have rated UHC well due to its supportive customer service department and smartphone app that can provide in-depth health analysis. UHC is the largest health insurance company by total policyholders. This is exemplified by the large suite of products that the provider offers, including health, dental, vision and disability.

Prefer to handle your insurance online? UnitedHealthcare also provides one of the best online health portals with virtual consultations at no additional cost. You can also schedule doctor appointments, view your claims and manage your policy all from your MyUHC account.

UnitedHealthcare Group offers broad health coverage with benefits in all 50 states and 130 countries. In 2020, the provider network included 1.3 million physicians and other healthcare professions and more than 6,500 hospitals. The company offers a range of products including health insurance, Medicare, Medicaid, short-term insurance, vision, dental, and supplemental coverage.

UnitedHealthcare, part of the country’s biggest health insurance company, offers the most robust network on our list. With coverage in every state, UnitedHealthcare may make it easier to find a health insurance plan with your preferred providers so that self-employed individuals don't have to skimp on medical care.

Best for Preventative Care: Kaiser Permanente

Kaiser Permanente offers unique provider network and a strong focus on preventative care. Kaiser Permanente is a private health insurance provider that operates as both your insurance provider and your network. Kaiser Permanente passes the savings along to you by cutting out the middleman and providing you with the care you need.

The company’s HMO plans are some of the most affordable in the country — an excellent choice if you’re struggling to access affordable care. Kaiser Permanente also offers a wide variety of plan options and tiers so you can customize your premium and the level of benefits you receive.

| Pros | Cons |

Below-average quotes | Only available in 9 states |

High customer satisfaction | Recent regulatory issues and customer complaints for skimping on behavioral healthcare |

| Excellent mobile app | Need to stay in the Kaiser Permanente network for most services |

Many services available in one location | |

| Ability to make appointments online or using an app | |

| Good customer service |

Kaiser Permanente was founded in 1945. Health insurance is often offered regionally, and Kaiser Permanente is no exception. It currently operates in California, Colorado, Georgia, Hawaii, Maryland, Virginia, Oregon, Washington, and Ohio. While limited to just 8 states and Washington, D.C., this insurer is known for affordable rates and a wide selection of options (if you live where it offers plans).

If you’re a little older but not quite ready for Medicare, you may also find a price advantage with Kaiser Permanente.

It is a nonprofit health insurance provider with years of industry experience. It offers employer-provided plans, Medicaid, Medicare, charitable health insurance, and other private insurance plans.

Kaiser Permanente offers quality patient treatment and care through its networks, which also makes it a good option. Kaiser Permanente health insurance plans provide insurance coverage at Kaiser Permanente hospitals and clinics. Each Kaiser facility is staffed with high quality health care providers including primary care physicians and specialists.

Members can receive several different kinds of medical care and treatment at one medical center, which makes receiving health care treatment convenient. This offering makes Kaiser Permanente stand out from other insurance providers. While some may find the restriction to receiving care only at a Kaiser Permanente Center, it is helpful if there's a Kaiser Permanente clinic or hospital in your community.

Kaiser Permanente has made a real name for itself in the States where the company is active, with competitively priced premiums and a comprehensive range of services. However, as an insurance provider, it does have limitations – namely that you are limited to the institutions and practitioners within its system. Therefore, it makes sense to do some research into the specific services in your region or state before weighing it up against its competitors.

Most customers will begin their enquiries at Kaiser Permanente's website and then as their requirements are analyzed, they will quickly be linked up with their local partners and healthcare providers. The quotation and claims processes are theoretically as straightforward as any healthcare provider, and the mobile app has attracted special praise for its usability and features.

You may get a quote or apply for coverage through Kaiser Permanente’s website. If you want financial assistance, you may apply through your state’s exchange or Healthcare.gov. Like the other providers, pricing may vary based on where you live, plan type, age, smoking status, and family size.

The claims process may depend on your health plan and must be within 12 months of the date of your service. There are some additional steps to submit a claim for an emergency or urgent care visit away from home.

As a self-employed or gig economy worker, you may have limited funds for spending extra money on healthcare and may benefit from Kaiser Permanente’s emphasis on preventative care. The company’s record-keeping and system of reminders make it easier to catch the early stages of a disease. As a result, the company leads the nation in preventative cancer screenings and keeping a cap on high blood pressure, which is why it wins this category.

Best for Convenience: Cigna

Cigna edged out the competition as best for convenience because of the company’s options for time-strapped, self-employed workers. The company’s options for $0 virtual care may save you from hours in the waiting room. There are also plenty of options for virtual behavioral and mental healthcare. You may also like prescription benefits if you’re working from home, including Express Scripts delivery, the country’s largest pharmacy benefit manager.

| Pros | Cons |

Cheap individual health insurance | Low ConsumerAffairs reviews |

Large variety of provider network choices | Limited transparency on company’s website |

| Solid company reputation | Customer service |

Virtual services and prescription delivery | Availability (can only be purchased in select states) |

Formed in 1982 by a merger between the Connecticut General Life Insurance Company (CG) and the INA Corporation, Cigna is currently one of the largest providers of health insurance, dental insurance, disability insurance, and life and accident insurance. In August 2018, Cigna bought the pharmacy administration company Express Scripts.

Cigna, a popular choice with employers for group health insurance plans, also offers individual plans in 12 states throughout the U.S. Dental plans are also available over a wider geographic territory.

Cigna customers can expect an expansive network of doctors and a practical assortment of health insurance plans, including high-deductible plans that qualify for health savings accounts. Cigna does not offer short term health insurance plans.

Cigna has wide-reaching networks in the states where is it is available. Even if your current doctor is not available on the Cigna network, you can petition to get in-network rates for their services through Cigna’s Transition of Care program.

Generally, your health services provider should make your claim for you. If, however, they did not make your claim or you visited an out-of-network provider, you can submit a claim directly to Cigna.

Cigna offers a number of options for busy self-employed workers. You may qualify for $0 virtual care (except for Arizona and Colorado). Self-employed workers may also love the convenience of Cigna’s Express Scripts Pharmacy—which offers home delivery for 90-prescriptions—along with 24/7 access to licensed pharmacists. Cigna recently added Talkspace, a popular digital therapy service, to its behavioral health network. This provider has worked hard in these areas to make care as convenient as possible, thus winning this category.

Best for Underserved Groups: Molina Healthcare

Molina Healthcare made our list because the company specializes in providing affordable healthcare for folks receiving government assistance. You may apply for a robust Molina plan for Medicaid, Medicare, or Integrated Medicaid/Medicare. You may also qualify for subsidies with a Marketplace Molina plan. The company pledges to keep out-of-pocket expenses down, and the MolinaCares Accord renews its commitment to improving access to quality care for all, making it our top choice for underserved groups.

| Pros | Cons |

Affordable coverage | Coverage not nationwide |

Plan transparency on website | Lower credit rankings |

| New program to improve healthcare access | History of regulatory issues including fines for not handling grievances |

Competitive quotes | |

| Website easy to use |

Molina Healthcare is one of the best health insurance companies, offering policies to the residents of 15 U.S. states: California, Florida, Idaho, Illinois, Michigan, Mississippi, New Mexico, New York, Ohio, Puerto Rico, South Carolina, Texas, Utah, Washington, and Wisconsin. It insures around 3.5 million people across America.

Molina offers Marketplace health plans, Medicare, and Medicaid options across most of its service areas, although not all plans are offered in all states. Molina today is a Fortune 500 company and covers more than 3.5 million people. In keeping with their founder’s goal of helping low-income patients, many of the plans offered are in conjunction with state-sponsored or federal programs.

Molina also participates in the marketplace, offering individual and family plans at all levels.

It employs over 20,000 people worldwide and has an annual revenue of around $20billion. The company was founded in California in 1980 by Dr David Molina with the aim of providing healthcare to underserved communities such as Hispanic and immigrant communities, looking to provide them with affordable, quality healthcare services rather than these families using the emergency room for general healthcare services.

Within the states where it operates, Molina’s preferred provider network encompasses around a million participating physicians and institutions.

Molina is generally highly regarded by its customers in the states where the company is active, with premiums priced below average and a comprehensive range of services and benefits. However, as with all health insurance providers, experiences can differ regionally and locally, and so it pays to research the options within a specific area for potential new customers.

Most customers will begin the quotation process at Molina's central website, which gives a clear overview of its services and products, and links potential customers to their regional and state-specific providers. The quotation and claims processes stand was comparable to its peers in terms of clarity and straightforward language.

Molina Healthcare focuses on affordable healthcare for lower-income families. If you’re self-employed and struggling to make ends meet, you may qualify for Medicaid, which offers comprehensive benefits through Molina. Qualified Illinois residents may also enroll in the Molina Dual Options plan that coordinates the benefits of both Medicare and Medicaid.

Best for Customer Service: Oscar

Oscar earned a place on our list because of the company’s expansive customer service. You have access to unique features through the company’s mobile app (like Doctor on Call and Concierge) which makes it easy to talk with a doctor 24/7 or refill a prescription. For those who prefer phone support, you may also contact their support team by phone, Monday through Friday from 9:00 a.m. to 8:00 p.m. EST.

| Pros | Cons |

Member benefits (Oscar app and Doctor On-Call) | Not available in all states |

Customer service through its concierge team | High deductibles |

| Hospital and provider networks | No dental or vision coverage |

Earn financial rewards for walking goals | No Medicaid plans |

No referrals needed for any plan | |

| 24/7 doctor on call online visits available |

Founded by Mario Schlosser, Joshua Kushner, and Kevin Nazemi, Oscar is a newer name among health insurance providers. It has grown from its initial startup since its founding in 2012. The company values simplicity and communication, so it seeks to simplify policies in order to better cover the needs of its clients.

With Oscar, customers can find plans with health savings accounts (HSAs) and traditional health insurance plans for individuals and families. Oscar also offers Medicare. Oscar does not offer dental or vision coverage.

Oscar Health Insurance was created to give customers a new, simple way to get health insurance and affordable care. Its plans include perks for things like reaching a fitness goal.

Oscar puts a strong emphasis on technology to cater to customers’ needs and add convenience to health care.

Another distinguishing feature of Oscar insurance is its Concierge team. Each team includes a registered nurse and a care guide who are available to assist you in finding network providers and answer basic health questions.

If you’re tired of mediocre customer service, Oscar may be worth a look. As a member, you may use Doctor on Call or Concierge through the company’s mobile app along with easy access to your records, lab results, deductibles, and more. The company’s white-glove service may be particularly appealing to self-employed folks navigating health insurance on their own for the first time.

Best for Older Self Employed Professionals: Humana

Are you a senior citizen? If so, you’ll typically have access to free or low-cost Medicare issued through the federal government. You might also want to choose a Medicare Advantage plan from a private company because Original Medicare doesn’t cover everything.

Humana specializes in offering exceptionally affordable Medicare Advantage plans intended to offer more coverage than Original Medicare. Many of Humana’s options offer $0 monthly premiums, and most plans also include $0 deductibles. You can even supplement your Medicare Advantage plan with a comprehensive prescription drug plan for as little as $13 per month. If you’re close to age 65 and think a Medicare Advantage plan might suit your needs, consider a plan from Humana.

| Pros | Cons |

Widely available across the country | Some Humana plans do not score well for satisfaction |

High-quality plans | Humana’s ownership may change |

| No copayments for COVID-19 testing and treatment | |

Special pricing at Walmart for certain prescription drug plans | |

| Humana Pharmacy is number one for mail-order prescriptions |

When choosing a health insurance company, you want an insurance provider who is well-established and has an excellent reputation within the insurance industry. Human Health Insurance Company has operations based in Louisville, Kentucky and is one of the largest health care insurers in the United States. It is a well-established player in the health insurance industry, providing insurance to almost 12 million with annual revenues of more than $33 billion. You can buy a health insurance policy from Humana in all 50 states and the District of Columbia as well as Puerto Rico.

The company sells individual insurance, Medicare plans and group health insurance plan to businesses. United Healthcare tried unsuccessfully to acquire Humana in 1998, but the merger failed.

Best Short-Term Health Insurance: Pivot

Pivot took first place as our best short-term health insurance pick for self-employed as there’s the flexibility to build the ideal policy for you and opportunities to save money with their discount programs.

| Pros | Cons |

Not tied to specific providers | Must pre-certify emergencies |

24/7 telemedicine | Not available across the country |

| Medication and vision care discounts |

With almost immediate coverage, the ability to visit any convenient doctor, flexible policy lengths, plus low prices, Pivot is our preferred short-term health insurance choice if you’re self-employed.

Since 2018, Pivot has offered short-term insurance plans underwritten by the Companion Life Insurance Company who has an AM Best financial stability rating of A+ (Superior). Other offerings include supplemental Insurance, pre-Medicare, Medicare supplement plans, limited Benefit insurance, dental, and vision policies.

Provided you live in Washington D.C. or one of the other 30 states that Pivot operates in, you can quote and purchase a policy online. The quote system allows you to select the features you want to include or exclude from their basic, core, quantum, or epic policies. Policies are renewable for up to 364 days.

Depending on your options, premiums begin at $99. Your expenses are limited by maximum out-of-pocket costs between $3,000 and $10,000. Annual benefit limits are capped at a maximum of $1 million. You’ll also need to cover coinsurance of 20% or 30% when you receive care.

Unlike the Marketplace Affordable Care Act policies, plans can exclude pre-existing conditions. Waiting times also differ from Marketplace: It's a five-day wait before health coverage kicks in and 30 days for cancer care.

Final Verdict

Being self-employed is rewarding but can be challenging when it comes to finding the right health insurance policy. Our round-up presents options that represent high-quality, flexible, and affordable choices.

In my opinion, Kaiser Permanente is not bad because of its unique provider network and a strong focus on preventative care. United Healthcare is an obvious choice for the best network category, as people in every state and most locations can join a plan. Pivot is the forerunner for our short-term health insurance pick as they provide the flexibility to build policies to suit self-employed people and offer discount programs. Finally, Oscar is our best for families option thanks to their child and family-friendly benefits, the cap on family deductibles, and tax-credit eligibility.

Extrabux is an international cashback shopping site, offering up to 30% cashback from 10,000+ Stores!

iHerb, Walgreens, Gousto, Orgain, Puritan's Pride, Pharmaca, Texas Superfood, Lloyds Pharmacy, Rite Aid, Dr. Schulze's, Vitacost, Myprotein AU, Vitabiotics, etc.

Join to get $20 welcome bonus now! (How does Welcome Bonus work?)

Recommendation

-

Is Turkish Airlines Good for International Flights?

-

10 Best & Stylish Winter Coats for Women on NET-A-PORTER in 2025

-

Top 12 Items That Are Always Cheaper at Sam's Club!

-

Top & Best 12 Sneaker Apps/Websites for Raffles, Releases & Restocks in 2025

-

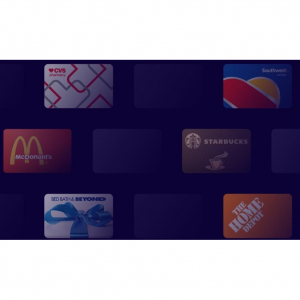

7 Best Gift Card Exchange Sites - Buy, Sell and Trade Discount Gift Card Safely and Instanly!